Fiscal Year : Oklahoma State Board of Education Approves $3.29 Billion ... : For example, if a company has a fiscal year from july 1.

Fiscal Year : Oklahoma State Board of Education Approves $3.29 Billion ... : For example, if a company has a fiscal year from july 1.. Definition and importance appeared first on smartasset blog. A fiscal year is an accounting period of 365(6) days that does not necessarily correspond to the calendar year beginning on january 1st. Sales were up in the last fiscal year. Our fiscal year runs from october 1 to september 30. A fiscal year is an annual period used for calculating financial statements in businesses and similar organizations.

In this video on what is fiscal year? How fiscal years work for federal budgets, businesses, and taxes. 65% of publicly traded companies have fiscal years that match calendar years. Fiscal year 2022 discretionary funding expense application filing period december 22, 2020. Because the fiscal year straddles two different calendar years, the calendar year and fiscal year will not always match.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

Here we discuss need for fiscal year along with its advantages. A fiscal year can have periods the same as the fiscal year assigned to company code through a fiscal year variant. A fiscal year is a period of twelve months, used by organizations in order to calculate their budgets, profits, and losses, at the end of which a firm's accounts are closed. A fiscal year is an accounting period of 365(6) days that does not necessarily correspond to the calendar year beginning on january 1st. Accounting year is called a fiscal year in sap. Oftentimes fiscal year is abbreviated to fy, such as fy 2020. specific fiscal years are referred to with the year in which they end. In the fiscal year variant. Businesses track income and expenses for reporting to the internal revenue service when citing a fiscal year (often denoted as fy), the year on which the closing date falls is.

A fiscal year (fy) is a company's annual financial reporting period.

What does fiscal year mean in finance? For example, if a company has a fiscal year from july 1. A fiscal year can have periods the same as the fiscal year assigned to company code through a fiscal year variant. Your business fiscal year is almost always your tax year, but it doesn't have to be. A fiscal year is a period of twelve months, used by organizations in order to calculate their budgets, profits, and losses, at the end of which a firm's accounts are closed. Accounting year is called a fiscal year in sap. A company's fiscal year may follow the calendar year, fiscal year, financial year, tax year. It is also used for financial reporting by businesses and other organizations. It may or may not correspond with the typical calendar year of january to. A fiscal year is most commonly used for accounting purposes to prepare financial. A fiscal year is an accounting period of 365(6) days that does not necessarily correspond to the calendar year beginning on january 1st. Your present tax year does not qualify as a fiscal year;or. Definition and importance appeared first on smartasset blog.

Here we discuss need for fiscal year along with its advantages. It is also used for financial reporting by businesses and other organizations. Our fiscal year runs from october 1 to september 30. Oftentimes fiscal year is abbreviated to fy, such as fy 2020. specific fiscal years are referred to with the year in which they end. A company's fiscal year may follow the calendar year, fiscal year, financial year, tax year.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

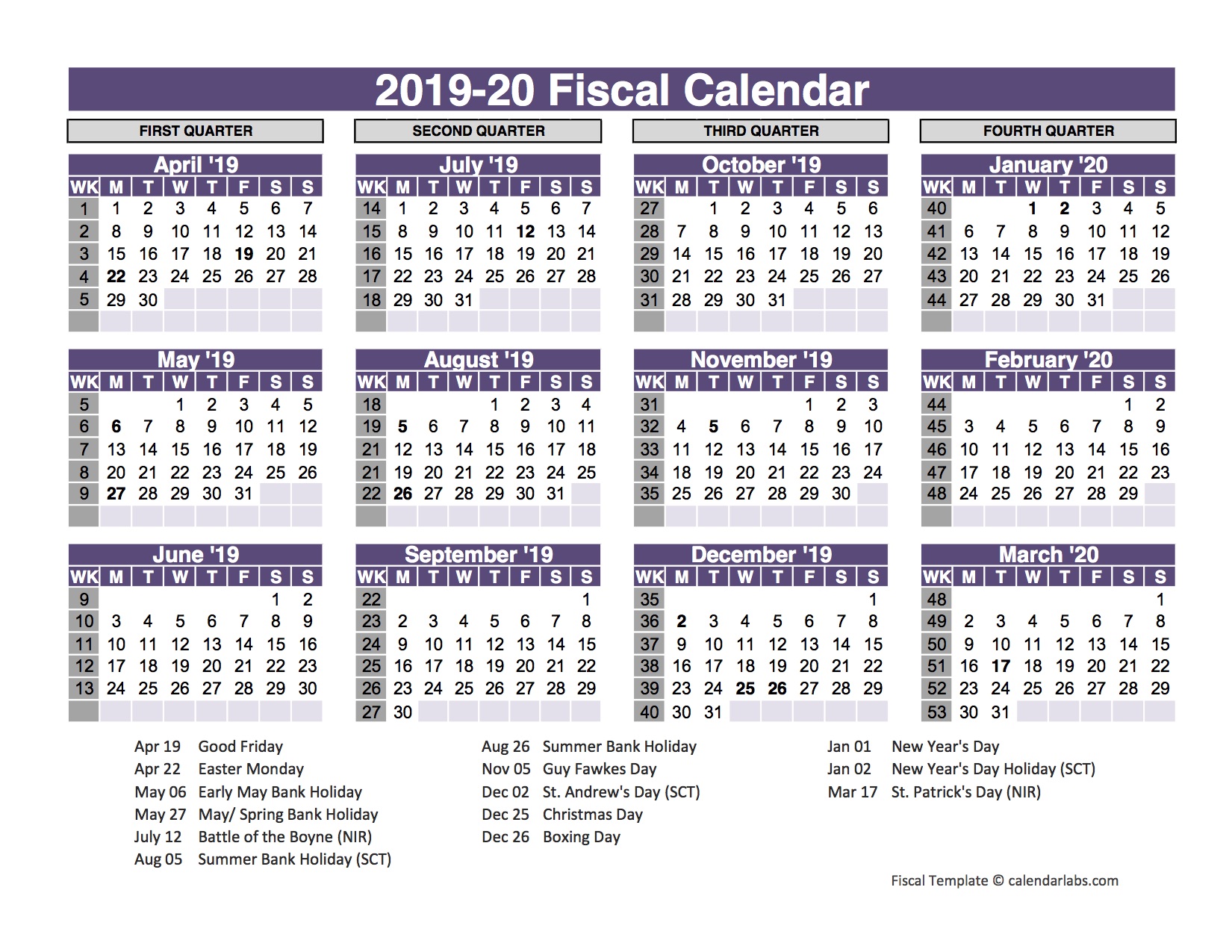

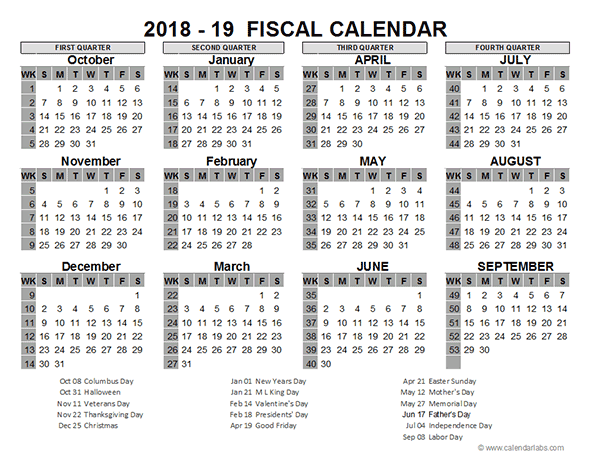

How fiscal years work for federal budgets, businesses, and taxes. A fiscal year is an accounting period of 365(6) days that does not necessarily correspond to the calendar year beginning on january 1st. Fiscal calendars can be based on a january 1 to december 31 calendar year. A fiscal year is most commonly used for accounting purposes to prepare financial. It is also used for financial reporting by businesses and other organizations. The fiscal year in the uk runs from 6th april one year to 5th april the following year. Sales were up in the last fiscal year. A particular fiscal year is often referred to by the numbers of the calendar years it covers, for example, the fiscal.

How fiscal years work for federal budgets, businesses, and taxes.

A fiscal year is a period of twelve months, used by organizations in order to calculate their budgets, profits, and losses, at the end of which a firm's accounts are closed. Each fiscal year is further broken down into segments called fiscal periods. Businesses track income and expenses for reporting to the internal revenue service when citing a fiscal year (often denoted as fy), the year on which the closing date falls is. A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. 65% of publicly traded companies have fiscal years that match calendar years. Each fiscal calendar contains one or more fiscal years, and each fiscal year contains multiple periods. Here we discuss need for fiscal year along with its advantages. A company's fiscal year may follow the calendar year, fiscal year, financial year, tax year. The fiscal year in the uk runs from 6th april one year to 5th april the following year. How fiscal years work for federal budgets, businesses, and taxes. Fiscal year 2022 discretionary funding expense application filing period december 22, 2020. Your present tax year does not qualify as a fiscal year;or. For example, if a company has a fiscal year from july 1.

A fiscal year is an accounting period of 365(6) days that does not necessarily correspond to the calendar year beginning on january 1st. A company's fiscal year may follow the calendar year, fiscal year, financial year, tax year. The fiscal year in the uk runs from 6th april one year to 5th april the following year. Our fiscal year runs from october 1 to september 30. A particular fiscal year is often referred to by the numbers of the calendar years it covers, for example, the fiscal.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

You are required to use a calendar year by a. A fiscal year can have periods the same as the fiscal year assigned to company code through a fiscal year variant. Fiscal year 2022 discretionary funding expense application filing period december 22, 2020. How fiscal years work for federal budgets, businesses, and taxes. Each fiscal year is further broken down into segments called fiscal periods. For example, if a company has a fiscal year from july 1. We also look at examples of fiscal. A company's fiscal year may follow the calendar year, fiscal year, financial year, tax year.

A fiscal year is a period of twelve months, used by organizations in order to calculate their budgets, profits, and losses, at the end of which a firm's accounts are closed.

In the fiscal year variant. It may or may not correspond with the typical calendar year of january to. Businesses track income and expenses for reporting to the internal revenue service when citing a fiscal year (often denoted as fy), the year on which the closing date falls is. How fiscal years work for federal budgets, businesses, and taxes. What does fiscal year mean in finance? You are required to use a calendar year by a. Fiscal year (fy) is referred to as a period lasting for twelve months and is used for budgeting, account keeping and all the other financial reporting for industries. It is also used for financial reporting by businesses and other organizations. Accounting year is called a fiscal year in sap. A particular fiscal year is often referred to by the numbers of the calendar years it covers, for example, the fiscal. Each fiscal calendar contains one or more fiscal years, and each fiscal year contains multiple periods. Because the fiscal year straddles two different calendar years, the calendar year and fiscal year will not always match. How to use fiscal year in a sentence.

Comments

Post a Comment